Idaho State Income Tax Rate 2025. Calculate your annual salary after tax using the online idaho tax calculator, updated with the 2024 income tax rates in idaho. See tax rate schedules for past years.

Idaho has a graduated income tax structure with seven tax brackets. Idaho has a progressive income tax system that features a top rate of 5.80%.

On January 1, 2024, Georgia Implemented A Flat Individual Income Tax Rate Of 5.49 Percent, Down From The State’s Previous Top Marginal Rate Of 5.75 Percent.

Property tax rates are relatively low in the state, while the average sales tax rate (state and county, combined) is also below.

The Income Tax Rate For 2023 Is 5.8% On Idaho Taxable Income.

Idaho has a graduated income tax structure with seven tax brackets.

Idaho State Income Tax Rate 2025 Images References :

Source: id-us.icalculator.com

Source: id-us.icalculator.com

2024 Idaho State Tax Calculator for 2025 tax return, Use this tool to compare the state income taxes in california and idaho, or any other pair of states. If you still need to.

Source: www.mortgagerater.com

Source: www.mortgagerater.com

Idaho Tax Rates Explored, You are able to use our idaho state tax calculator to calculate your total tax costs in the tax year 2024/25. The combined corporate and personal income tax relief proposed under the bill is estimated to be around $59.1 million for fiscal year 2025.

Source: executiveperkscoffees.com

Source: executiveperkscoffees.com

Individual Tax Rate Schedule Idaho State Tax Commission, The 2024 tax rates and thresholds for both the idaho state tax tables and federal tax tables are comprehensively integrated into the idaho tax calculator for 2024. Idaho’s tax rate is now 5.695% for all taxpayers.

Source: 100kosarei.blogspot.com

Source: 100kosarei.blogspot.com

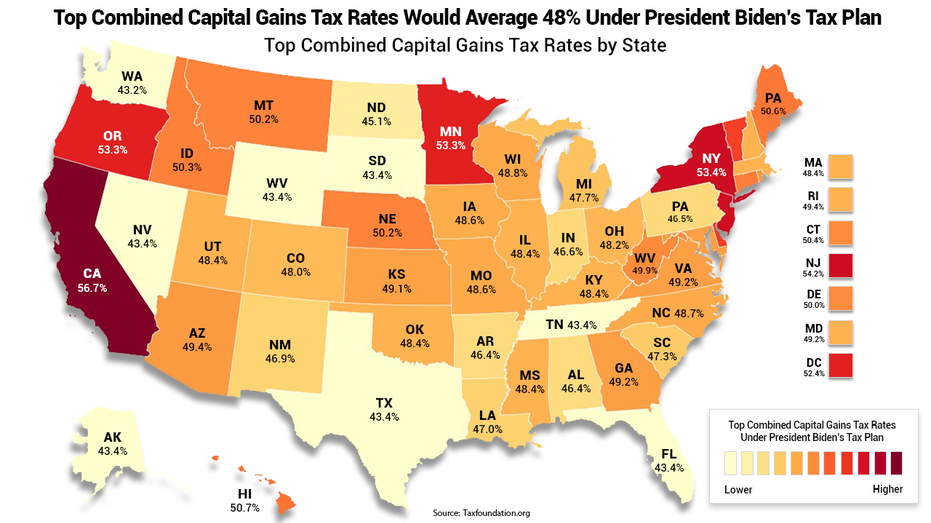

idaho state tax capital gains Marlyn Walston, Idaho’s tax rate is now 5.695% for all taxpayers. Detailed information about idaho state income tax brackets and rates, standard deduction information, and tax forms by tax year etc.

Source: www.taxpolicycenter.org

Source: www.taxpolicycenter.org

T200018 Baseline Distribution of and Federal Taxes, All Tax, Idaho has a graduated income tax structure with seven tax brackets. Construction continues on boise fire station 13 at the corner of bogart lane and state street on wednesday.

Source: alisonqfrancoise.pages.dev

Source: alisonqfrancoise.pages.dev

Idaho State Tax Brackets 2024 Fifi Orella, Idaho has a progressive income tax system that features a top rate of 5.80%. Calculate your annual salary after tax using the online idaho tax calculator, updated with the 2024 income tax rates in idaho.

Source: idahofreedom.org

Source: idahofreedom.org

Resorting to bribery Idaho Freedom Foundation, Use this tool to compare the state income taxes in california and idaho, or any other pair of states. If you still need to.

Source: www.pdffiller.com

Source: www.pdffiller.com

Fillable Online tax idaho Individual tax rate schedule Idaho, You can quickly estimate your idaho state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. There are only two income tax brackets in idaho.

Source: www.idahostatesman.com

Source: www.idahostatesman.com

ID property taxes burden poor more than rich report Idaho, Narrowed a federal obstruction charge that has been used against hundreds of people who took part in the violent assault on the capitol on jan. Calculate your tax rate based upon your taxable income (the first two columns).

Source: livewell.com

Source: livewell.com

What Is The State Tax In Idaho LiveWell, Use this tool to compare the state income taxes in california and idaho, or any other pair of states. A separate federal court ruling blocked the administration from implementing a component of the save plan that would lower an undergraduate's monthly payment rate.

Our Calculator Has Recently Been Updated To Include Both The Latest.

If you still need to.

This Tool Compares The Tax Brackets For Single Individuals In Each State.

Idaho imposes a flat income tax rate of 5.8% on taxable income over $2,500 ($5,000 for joint filers) for tax year 2023.